COMPRA SEGURA

Parcele em até 3x sem juros

Produtos em Destaque

Vitrine - Produtos em Destaque

Etiqueta Resinada - Modelo Redondo / Quadrado - Móveis e Veículos

R$129,99

R$99,99

R$99,99 No PIX!!

ou em 3x de R$33,33 sem juros

ou em 3x de R$33,33 sem juros

Vitrine - Produtos em Destaque

Etiqueta Resinada - Modelo Retangular - Móveis e Veículos

R$129,99

R$99,99

R$99,99 No PIX!!

ou em 3x de R$33,33 sem juros

ou em 3x de R$33,33 sem juros

Vitrine - Produtos em Destaque

2 Tampa Placas Personalizada com Verniz Localizado

R$129,80

R$79,99

R$79,99 No PIX!!

ou em 3x de R$26,66 sem juros

ou em 3x de R$26,66 sem juros

Vitrine - Produtos em Destaque

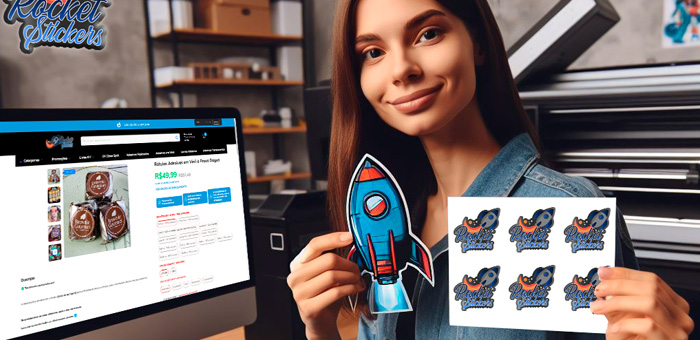

Rótulos Adesivos em Vinil à Prova Dágua

R$67,49

R$59,99

R$59,99 No PIX!!

ou em 3x de R$20,00 sem juros

ou em 3x de R$20,00 sem juros

Vitrine - Produtos em Destaque

Adesivo em Vinil com Acabamento UV Gloss Spot

R$206,80

R$194,99

R$194,99 No PIX!!

ou em 3x de R$65,00 sem juros

ou em 3x de R$65,00 sem juros

Vitrine - Produtos em Destaque

Adesivo em Vinil Branco - Impressão UV

R$67,49

R$59,99

R$59,99 No PIX!!

ou em 3x de R$20,00 sem juros

ou em 3x de R$20,00 sem juros

Vitrine - Produtos em Destaque

Adesivo em Vinil Transparente - Impressão UV

R$83,42

R$69,99

R$69,99 No PIX!!

ou em 3x de R$23,33 sem juros

ou em 3x de R$23,33 sem juros

Vitrine - Produtos em Destaque

100 unidades 5x5cm - Adesivo Resinado Personalizado - Não Amarela!

R$239,99

R$219,99

R$219,99 No PIX!!

ou em 3x de R$73,33 sem juros

ou em 3x de R$73,33 sem juros

Vitrine - Produtos em Destaque

100 unidades 10x10cm - Adesivo Resinado Personalizado - Não Amarela!

R$786,50

R$735,60

R$735,60 No PIX!!

ou em 3x de R$245,20 sem juros

ou em 3x de R$245,20 sem juros

Vitrine - Produtos em Destaque

300 unidades 5x2cm - Adesivo Resinado Personalizado - Não Amarela!

R$326,60

R$264,50

R$264,50 No PIX!!

ou em 3x de R$88,17 sem juros

ou em 3x de R$88,17 sem juros

Vitrine - Produtos em Destaque

300 unidades 4x2cm - Adesivo Resinado Personalizado - Não Amarela!

R$326,60

R$228,60

R$228,60 No PIX!!

ou em 3x de R$76,20 sem juros

ou em 3x de R$76,20 sem juros

Vitrine - Produtos em Destaque

100 unidades 6x6cm - Adesivo Resinado Personalizado - Não Amarela!

R$329,60

R$264,80

R$264,80 No PIX!!

ou em 3x de R$88,27 sem juros

ou em 3x de R$88,27 sem juros

Vitrine - Produtos em Destaque

300 unidades 6x6cm - Adesivo Resinado Personalizado - Não Amarela!

R$825,60

R$719,80

R$719,80 No PIX!!

ou em 3x de R$239,93 sem juros

ou em 3x de R$239,93 sem juros

Vitrine - Produtos em Destaque

500 unidades 5x5cm - Adesivo Resinado Personalizado - Não Amarela!

R$1.199,95

R$999,99

R$999,99 No PIX!!

ou em 3x de R$333,33 sem juros

ou em 3x de R$333,33 sem juros

Vitrine - Produtos em Destaque

300 unidades 5x5cm - Adesivo Resinado Personalizado - Não Amarela!

R$719,99

R$649,80

R$649,80 No PIX!!

ou em 3x de R$216,60 sem juros

ou em 3x de R$216,60 sem juros

Vitrine - Produtos em Destaque

100 unidades 7x7cm - Adesivo Resinado Personalizado - Não Amarela!

R$415,70

R$369,80

R$369,80 No PIX!!

ou em 3x de R$123,27 sem juros

ou em 3x de R$123,27 sem juros

Vitrine - Produtos em Destaque

100 unidades 8x8cm - Adesivo Resinado Personalizado - Não Amarela!

R$529,80

R$479,60

R$479,60 No PIX!!

ou em 3x de R$159,87 sem juros

ou em 3x de R$159,87 sem juros

Vitrine - Produtos em Destaque

100 unidades 9x9cm - Adesivo Resinado Personalizado - Não Amarela

R$728,60

R$589,80

R$589,80 No PIX!!

ou em 3x de R$196,60 sem juros

ou em 3x de R$196,60 sem juros

Vitrine - Produtos em Destaque

500 unidades 5x2cm - Adesivo Resinado Personalizado - Não Amarela!

R$554,80

R$484,60

R$484,60 No PIX!!

ou em 3x de R$161,53 sem juros

ou em 3x de R$161,53 sem juros

Vitrine - Produtos em Destaque

Adesivo com Sabor e Validade / Sua logo

R$67,49

R$59,99

R$59,99 No PIX!!

ou em 3x de R$20,00 sem juros

ou em 3x de R$20,00 sem juros

Vitrine - Produtos em Destaque

200 unidades 7x3cm - Adesivo Resinado Personalizado - Não Amarela!

R$424,80

R$378,60

R$378,60 No PIX!!

ou em 3x de R$126,20 sem juros

ou em 3x de R$126,20 sem juros

Vitrine - Produtos em Destaque

200 unidades 6x3cm - Adesivo Resinado Personalizado - Não Amarela!

R$424,80

R$378,60

R$378,60 No PIX!!

ou em 3x de R$126,20 sem juros

ou em 3x de R$126,20 sem juros

Vitrine - Produtos em Destaque

Adesivo Termocolante UV - Roupas e Tecidos

R$189,90

R$104,60

R$104,60 No PIX!!

ou em 3x de R$34,87 sem juros

ou em 3x de R$34,87 sem juros

Vitrine - Produtos em Destaque

2 Cartelas Adesivos pra Moto com 20 10x4cm Adesivos Em Vinil Cartela Bicicleta, Moto, Carro, Bike

R$34,90

R$9,99

R$9,99 No PIX!!

ou em 1x de R$9,99 sem juros

ou em 1x de R$9,99 sem juros

Mais Vendidos

Vitrine - Mais Vendidos

2 Tampa Placas Personalizada com Verniz Localizado

R$129,80

R$79,99

R$79,99 No PIX!!

ou em 3x de R$26,66 sem juros

ou em 3x de R$26,66 sem juros

Vitrine - Mais Vendidos

Etiqueta Resinada - Modelo Retangular - Móveis e Veículos

R$129,99

R$99,99

R$99,99 No PIX!!

ou em 3x de R$33,33 sem juros

ou em 3x de R$33,33 sem juros

Vitrine - Mais Vendidos

Etiqueta Resinada - Modelo Redondo / Quadrado - Móveis e Veículos

R$129,99

R$99,99

R$99,99 No PIX!!

ou em 3x de R$33,33 sem juros

ou em 3x de R$33,33 sem juros

Depoimentos de Clientes

"Pra algumas pessoas pode não parecer muito, mas pra nós é sempre muito, ver nosso crescimento!! Obrigada a toda equipe Rocket Stickers GO! Adesivos Personalizados, por se dedicarem ao cliente. "

"Super indico, atendimento é maravilhoso e a qualidade é excelente. Toda a equipe está de parabéns pois fui muito bem atendida. Obrigadaaaaa! <3 "

"Meus rótulos adesivos chegaram perfeitos. Adorei a qualidade. O recorte é bem preciso! "